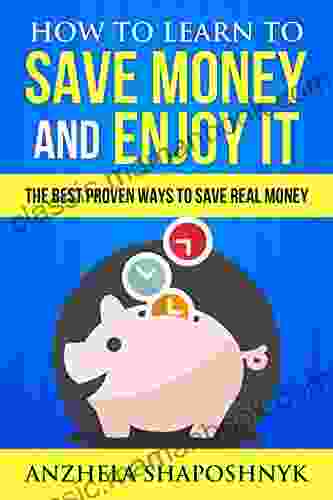

How to Learn to Save Money and Enjoy It: A Comprehensive Guide for Financial Well-being

Embarking on a journey of saving money can seem like an arduous task, but it doesn't have to be. By adopting a proactive mindset and implementing proven strategies, you can effectively reduce expenses, achieve your financial goals, and enjoy a comfortable lifestyle without feeling deprived. 4.1 out of 5 At the heart of successful saving lies a clear understanding of your financial aspirations. Determine your short-term and long-term goals, whether it's purchasing a home, funding your child's education, or securing a comfortable retirement. A budget is the cornerstone of effective money management. It provides a framework for tracking your income, expenses, and savings, empowering you to make informed financial decisions. Saving money is not just about cutting back on luxuries; it's about optimizing your spending and eliminating unnecessary expenses that drain your financial resources. In addition to reducing expenses, consider exploring opportunities to increase your income. This can provide you with additional funds to save and accelerate your financial progress. Make saving a habit by automating monthly transfers from your checking account to a dedicated savings account. This eliminates the temptation to spend and ensures consistent savings. Saving money requires discipline and consistency. Stay motivated by focusing on your goals, celebrating milestones, and rewarding yourself for progress. Saving money isn't just about accumulating wealth; it's about gaining financial freedom, security, and peace of mind. By embracing the strategies outlined in this guide, you can reap the following benefits: Saving money is not a sacrifice; it's an investment in your future. By following the strategies outlined in this comprehensive guide, you can effectively reduce expenses, increase your income, and automate savings. Stay motivated, celebrate your progress, and experience the transformative power of financial freedom. Remember, learning to save money is a journey, not a destination. Embrace the process, enjoy the benefits, and secure a brighter financial future for yourself and your loved ones. Embrace a New Mindset and Unlock the Power of Saving

Language : English File size : 793 KB Text-to-Speech : Enabled Screen Reader : Supported Enhanced typesetting : Enabled Word Wise : Enabled Print length : 20 pages Lending : Enabled Define Your Financial Dreams: Set Clear and Meaningful Goals

Take Control of Your Finances: Create a Comprehensive Budget

Unlock Savings Potential: Identify and Reduce Unnecessary Expenses

Boost Your Earnings: Explore Ways to Increase Your Income

Effortless Savings: Automate Your Savings Plan

Maintain Momentum: Stay Committed and Enjoy the Journey

Experience the Rewards: Financial Freedom, Security, and Peace of Mind

Unlock Your Financial Potential: Embrace the Journey of Saving Money

4.1 out of 5

| Language | : | English |

| File size | : | 793 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 20 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Hormel Foods

Hormel Foods Meia Monae

Meia Monae C W Nicol

C W Nicol Richard Rhodes

Richard Rhodes Tg Reid

Tg Reid Brandon Guns

Brandon Guns Shara Mccallum

Shara Mccallum Tyrell Madison

Tyrell Madison Rob Gifford

Rob Gifford Lev Grossman

Lev Grossman William Powell

William Powell Mary Gibson

Mary Gibson Jess Whitecroft

Jess Whitecroft Laurel Ulrich

Laurel Ulrich Boyd Craven Jr

Boyd Craven Jr J Todd Hawkins

J Todd Hawkins David Rooney

David Rooney J R Nichols

J R Nichols Susan August

Susan August Dr Georgi Losanov

Dr Georgi Losanov

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Fred FosterFollow ·14.7k

Fred FosterFollow ·14.7k Tyrone PowellFollow ·7.5k

Tyrone PowellFollow ·7.5k Bryan GrayFollow ·3.2k

Bryan GrayFollow ·3.2k Blake BellFollow ·8k

Blake BellFollow ·8k Elmer PowellFollow ·6.3k

Elmer PowellFollow ·6.3k Jason HayesFollow ·18.1k

Jason HayesFollow ·18.1k Curtis StewartFollow ·14.1k

Curtis StewartFollow ·14.1k Garrett BellFollow ·6.8k

Garrett BellFollow ·6.8k

Bryan Gray

Bryan GrayCello Alternativo: Exploring Contemporary Pizzicato...

: Embracing the Avant-Garde Within...

Victor Hugo

Victor HugoThe Social Revolution: Barry Libert's Vision for a More...

In a world where...

Tony Carter

Tony CarterA Comprehensive Guide to Crafting Clear and Effective Job...

A job description is a critical tool...

Deacon Bell

Deacon BellSelected Poems And Prose Lorenzo Da Ponte Italian Library

Lorenzo Da Ponte, born...

Francisco Cox

Francisco CoxWhat You Need To Know About Opportunity Cost: A...

Opportunity cost is a fundamental concept...

Bill Grant

Bill GrantWhy Our Kids With Behavioral Challenges Are Falling...

Every year,...

4.1 out of 5

| Language | : | English |

| File size | : | 793 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 20 pages |

| Lending | : | Enabled |